No, the President of India Is Not Exempted from Income Tax

After President Ram Nath Kovind said he pays Rs 2.75L in taxes, several Congress leaders claimed his income is tax free

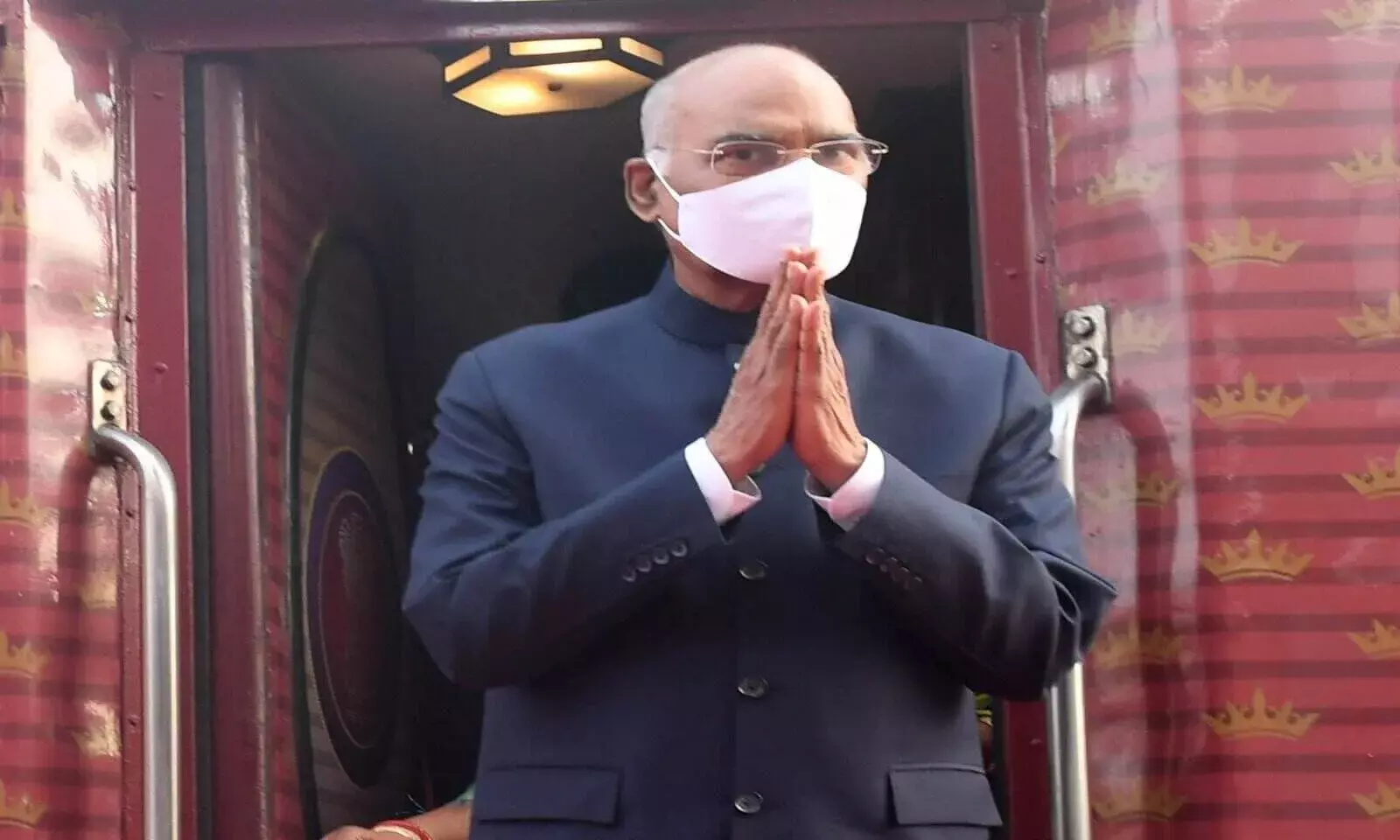

Image Source: President of India's Twitter Account

President Ram Nath Kovind, on June 27, 2021, said his salary is Rs 5 lakh a month and of it, Rs 2.75 lakh go into taxes. The President made this claim while urging people to pay taxes regularly for the sake of development in the country, at an event organised at the Jhinjhak railway station while on a three-day visit to Uttar Pradesh.

"I am mentioning this because everyone knows that there is nothing wrong. The President is the country's highest paid employee but he also pays taxes. I pay Rs 2.75 lakh as tax each month. Everyone says I get Rs 5 lakh a month, but it is taxed too," Kovind said. "But how much is left? Whatever I save, our officials earn more than that. The teachers here earn more."

राष्ट्रपति बोले- मुझे 5 लाख प्रति महीना तनख्वाह मिलती है जिसमें से पौने 3 लाख टैक्स चला जाता है, हमसे ज्यादा बचत तो एक टीचर की होती है#presidentkovind #UttarPradesh pic.twitter.com/D6MAgmFCZm

— News24 (@news24tvchannel) June 27, 2021

Ever since he made this remark, Twitter has been flooded with criticism of the statement. Congress' National Executive Niraj Bhatia claimed that the President's salary is tax free.

The First Citizen Of Country doesn't know his salary is tax free The President's (Emoluments) and Pension Act, 1951 ? https://t.co/LLGNrnWBBu

— Niraj Bhatia (@bhatia_niraj23) June 27, 2021

So did, Congress Secretary Jitendra Baghel

The salary of President of India is non taxable, how come Hon'ble President pay tax?#PresidentKovind pic.twitter.com/8Z4PoTaU09

— Jitendra Baghel जितेन्द्र बघेल (@JitendraBaghel_) June 29, 2021

Another Congress member too tweeted saying the President's salary is exempt from taxes

Dear @rashtrapatibhvn your salary is exempt from tax under President's (Emoluments) and Pension Act-1951. https://t.co/R9OTw71uc9

— Lavanya Ballal | ಲಾವಣ್ಯ ಬಲ್ಲಾಳ್ (@LavanyaBallal) June 27, 2021

One blogger with more than 3.47 lakh followers on Twitter also made a similar comment

President's salary is five lakhs and is tax free. @rashtrapatibhvn

— Hansraj Meena (@HansrajMeena) June 27, 2021

But is this true? Does the income tax law exempt the salary of the President from taxation? How much income tax should the President pay and what benefits does he and his family receive? To understand all of this, FactChecker spoke to legal experts and looked at India's taxation laws.

Does the President pay taxes?

Yes.

The President's Emoluments and Pension Act, 1951 sets down provisions for salary and post-retirement benefits for the President of India. The President's salary is charged from the Consolidated Fund of India under Article 266(1) of the Indian Constitution.

"The Constitution provides that the President's emoluments, allowances and privileges will be decided by the Parliament. The salary of the President of India is thus determined by the 1951 President's (Emoluments) and Pensions Act. Through an amendment to the Finance Bill in 2018, the President's salary was last revised to Rs 5 lakh per month. Neither the Constitution nor the President's (Emoluments) and Pensions Act, 1951 exempt the Heads of State from taxation," Mridhula Raghavan from PRS Legislative Research, a non-profit legal research organization based in Delhi, told FactChecker.

In 2017, the salary of the President was increased to Rs 5 lakh from 1.5 lakh a month. As per his current salary, he draws Rs 60 lakhs per annum. Additionally, he receives other allowances such as free accommodation and medical attendance and treatment.

According to Section 10 of the Income Tax Act 1961, any income which is not specifically exempted from income tax under a law is considered to be taxable. Various categories of income are exempt from income tax but there is no mention of the President's income being tax free.

FactChecker tried calling the President's Secretariat office and also tried contacting the Secretary to the President KD Tripathi for a comment. However, we hadn't received a response at the time this article was published. We will update the story as and when we do.

Is the tax that much?

TP Ostwal, managing partner of audit firm TP Ostwal & Associates LLP in Mumbai, said, according to the current income tax laws, the President has to pay around Rs 20 lakh per annum as tax which is about 1.7 lakh per month.

"It all depends on how much he invests into the tax savings scheme. Rs 2.75 is a bit of an exaggerated number. This means he pays more than 50%? Indian tax rates don't cut more than 35% and that too a highest tax bracket where an income is beyond Rs 2 crore is 42.7%. But his income is not more than Rs 2 crore," said Ostwal.

But there are other factors too. In March 2020, Kovind contributed a month's salary to the PM-CARES Fund and in May 2020, the President, Vice-President and other Union Ministers and Members of the Parliament decided to forego 30% of their pay in 2020-21 to contribute to the Consolidated Fund of India and help fight the pandemic. This means the President's salary was Rs 3.5 lakh between May 2020 and April 2021.

According to the IT Act, the President's age or senior citizen status and information on his investments is taken into consideration. However, the President's investments or the nature of his income is not disclosed to the public. Since the President is 75 years old, a senior citizen, and earns more than Rs 15 lakh per annum, he has to pay 30% income tax, according to the current tax rates.

If we consider the 30% pay cut in 2020-21, the annual income of the President stood at 42 lakh per year or 3.5 lakh a month till April 2021.

Ostwal also pointed at perquisite benefits like house and car allowances. "If we take all these together the possibility of what he has said cannot be ruled out. Because of perquisites, there could be some additional tax on that perquisite income. That could increase his tax liability," he added.

Benefits to retiring Presidents

Every former president (either by the expiration of their term of office or by resignation of their office) will receive a pension of half (50%) of their current salary, reads The President's Emoluments and Pension Act, 1951. This means that if President Kovind's current salary is Rs 5 lakh, he will receive Rs 2.5 lakh post retirement for the rest of his life.

1. A former president is also entitled to a rent-free furnished residence which includes maintenance charges. The explanation of residence includes staff quarters and gardens and maintenance includes the payment of local rates taxes and the provision of water and electricity.

2. Two telephones (one for internet and broadband connectivity), one mobile phone with national roaming facility.

3. An official car, free of charge or a car allowance.

4. Secretarial staff consisting of a Private Secretary, one Additional Private Secretary, one Personal Assistant, two Peons and office expenses up to Rs one lakh per annum.

5. Free medical attendance and treatment.

6.They are also free to travel anywhere in India, accompanied by one person, by the highest class by air, rail or steamer.

Allowances for spouses of Presidents

In the event of the death of a President while holding office or after the expiration of their term, the surviving spouse shall be entitled to a family pension at the rate of 50% of pension as is given to a retiring President, for the rest of their life.

Apart from this, the spouse is entitled to free medical attendance, treatment. Further, they are granted rent-free furnished accommodation including maintenance, a private secretary, a peon and office expenses not exceeding Rs 20,000 per annum. They will also get a telephone and an official car.

Also, they are permitted to travel anywhere in the country, restricting them to 12 single journeys in a calendar year, by the highest class, by air, rail or steamer, accompanied by a companion or a relative.