Jaitley Right--And Wrong--On Currency In Circulation

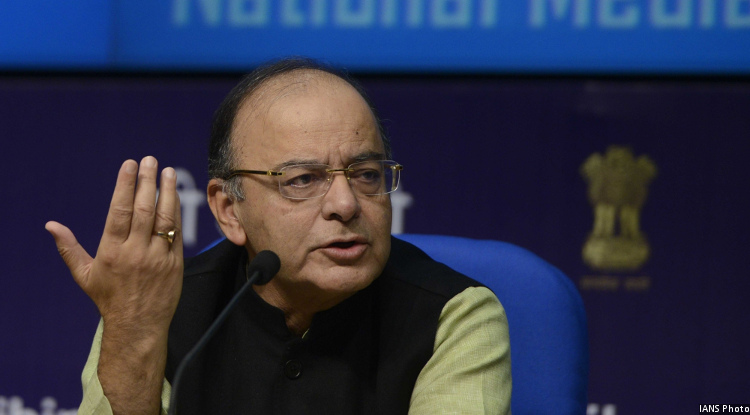

As one justification for scrapping 86% of India’s currency by value, Finance Minister Arun Jaitley--implying too much currency was circulating in India--said on November 22, 2016, that currency is 4% of gross domestic product (GDP) in most developed nations, while in India it is 12%.

In most developed nations, 4% of GDP is currency; in India it is 12%: FM @arunjaitley #DeMonetisation

— PIB India (@PIB_India) November 22, 2016

Currency with the public in India was almost 12% of GDP in the financial year 2015-16, up from 11% last year, rising 33% over the last three years to October 2016, according to data published by the Reserve Bank of India (RBI).

Source: Reserve Bank of India

A global comparison shows that although the currency in circulation in many countries is lesser than in India, it is not necessarily 4% as claimed by the finance minister.

In the United States, as much as $1.48 trillion is in circulation, according to data released by the Federal Reserve, which works out to approximately 8% of its GDP, or double the 4% that Jaitley cited.

*Calculated with respective reserve banks data of currency in circulation and the exchange rate adjusted GDP figures. (2015-16)

Source: Federal Reserve, Bank of England, Bank of Canada, Reserve Bank of Australia, Reserve Bank of India, World Bank.

Currency in circulation in some BRICS (Brazil, Russia, India, China, South Africa) nations, such as Brazil (4.4%)and Russia (8.9%), is lower than in India, although it is more than 4%.

“Higher the circulation of money, more transactions take place out of the banking system,” said Jaitley. Indeed, the proportion of cash to bank deposits has steadily risen.

Over the last three years (2013-16), cash with the Indian public was 50% more than the money they kept in banks, IndiaSpend reported on November 12, 2016. In 2007, currency and bank deposits were almost equal, according to RBI data.

Source: Reserve Bank of India Bulletin

By one estimate, cash still accounts for almost 90% of all monetary transactions in India.

(Spencer holds an M.A. in public policy from St Xavier’s College, Mumbai, and is an intern with IndiaSpend.)