Modi’s Claims On Affordable Insurance For Poor Partially True

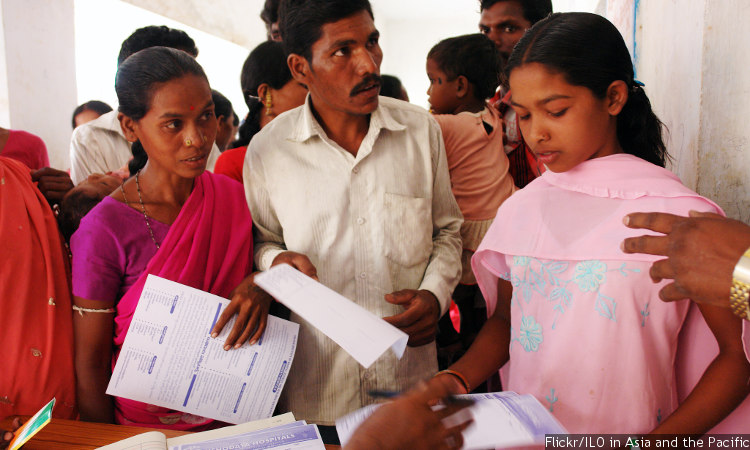

Beneficiaries enroll themselves for the Rashtriya Swasthya Bima Yojana (RSBY) in Andhra Pradesh. Of the 59.1 million below poverty line families identified to be covered under RSBY, 36.3 million (61%) were enrolled by March 2017.

On November 30, 2017, Prime Minister Narendra Modi, while addressing the inaugural session of the 15th edition of the Hindustan Times Leadership Summit, claimed that the poor now have access to health and life insurance at minimal cost.

#HTLS2017 | The poor now have access to health and life insurance at a minimal cost: PM Modi pic.twitter.com/CEmWdDNUSc

— Hindustan Times (@htTweets) November 30, 2017

The claim was immediately refuted on the social media.

This is not true. This man is a liar.

— Vidya (@VidyaKrishnan) November 30, 2017

9 of India's poorest states, home to 581mn or 48% popu, account for 70% of infant deaths, 75% U5MR & 62% maternal deaths. They dont spend money set aside for healthcare, accd to IndiaSpend analysis of 2017 RBI data on state budgets. https://t.co/CmXdzqkJfP

We fact-checked his claims and found them to be partially true.

The Modi government is continuing with the Rashtriya Swasthya Bima Yojana (RSBY, National Health Insurance Programme), launched by the earlier government in 2008, for providing health insurance.

The Modi government launched two life insurance schemes in 2015, Pradhan Mantri Suraksha Bima Yojana (Prime Minister’s Accident Insurance Scheme) and Pradhan Mantri Jeevan Jyoti Bima Yojana (Prime Minister’s Light of Life Scheme) for eligible bank account holders.

Of the 59.1 million eligible below poverty line (BPL) families, 36.3 million (61.4%) families have been enrolled in RSBY by March 2017.

The two life insurance programmes have insured only 12.6%, and 4.8% bank account holders, respectively, at the end of April 30, 2017, according to this reply to the Lok Sabha (lower house of Parliament) on August 11, 2017.

Health insurance for poor still a long way to go

RSBY is a centrally-sponsored scheme to cover BPL families and 11 designated categories: National Rural Employment Guarantee Act workers, construction workers, domestic workers, sanitation workers, mine workers, licensed railway porters, street vendors, beedi workers, rickshaw pullers, rag pickers and auto/taxi drivers. Those enrolled under RSBY are entitled for cashless health insurance claims of Rs 30,000 per annum per family, according to this reply to the Lok Sabha on December 2, 2016.

While the central government pays 75% of the total premium (90% in case of Jammu & Kashmir and the north-eastern states), the state governments pay the remaining premium. The state governments select insurance companies through open tendering, and the technically qualified, lowest bid is selected to offer insurance to subscribers.

Source: Rashtriya Swasthya Bima Yojana

Low enrolment, inadequate insurance cover and the lack of insurance for outpatient costs are some of the major drawbacks of RSBY, according to this 2017 study published in Social Science Medicine, a global journal.

The cost of outpatient treatment, which the poor prefer over hospitalisation, forms 65.3% of out-of-pocket expenditure in India, according to a 2016 Brookings report, IndiaSpend reported on October 17, 2017. But these are not covered by RSBY.

Also, while the cost of hospitalisation has gone up more than 10% between 2004 and 2014, RSBY’s hospitalisation costs covered under RSBY scheme have remained unchanged.

India was ranked 182 of 192 countries in terms of out-of-pocket expenditure as a percentage of health expenditure, according to this reply to the Lok Sabha on March 14, 2017. Indians spend 89.2% of private expenditure on health from their own pockets, according to World Bank data.

Over 63 million persons are faced with poverty every year due to healthcare costs alone because there is no financial protection for the vast majority of healthcare needs, according to this 2016 report by Global Health Strategies, an advocacy.

Number of people covered by life insurance policies increasing but still not adequate

Insurance penetration is likely to cross 4% by the end of the year on the back of various insurance schemes launched by the government, The Mint reported on February 15, 2017.

Penetration rate indicates the level of development of the insurance sector in a country and is measured as the ratio of premium paid in a particular year to the gross domestic product (GDP).

The Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY, Prime Minister’s Light of Life Scheme) is a one-year life insurance scheme offering a life cover of Rs 200,000 for death due to any reason. The cover is available to people in the age group of 18-50 years (life cover up to age 55) having a savings bank account who give their consent to join and enable auto-debit of the premium of Rs 330 per annum per member.

The Pradhan Mantri Suraksha Bima Yojana (PMSBY, Prime Minister’s Accident Insurance Scheme) is a one-year life insurance scheme offering a life cover of Rs 200,000 for accidental death and permanent total disability and Rs 100,000 for permanent partial disability at a premium of Rs 12 per year. The scheme is available to people in the age group 18-70 years with a savings bank account who give their consent to join and enable auto-debit on an annual renewal basis.

While PMSBY had insured 12.6% of the eligible bank account holders, PMJJBY had provided insurance to 4.8% account holders as of April 30, 2017, according to this reply to the Lok Sabha on August 11, 2017.

Source: Lok Sabha

The claim-to-premium ratio, or claims settled by insurance companies to premium paid, for PMJJBY was nearly 84%; for PMSBY, it was 115%, according to this reply to the Lok Sabha on August 11, 2017.

(Salve is an analyst, and Mohan is an intern with IndiaSpend and FactChecker.)